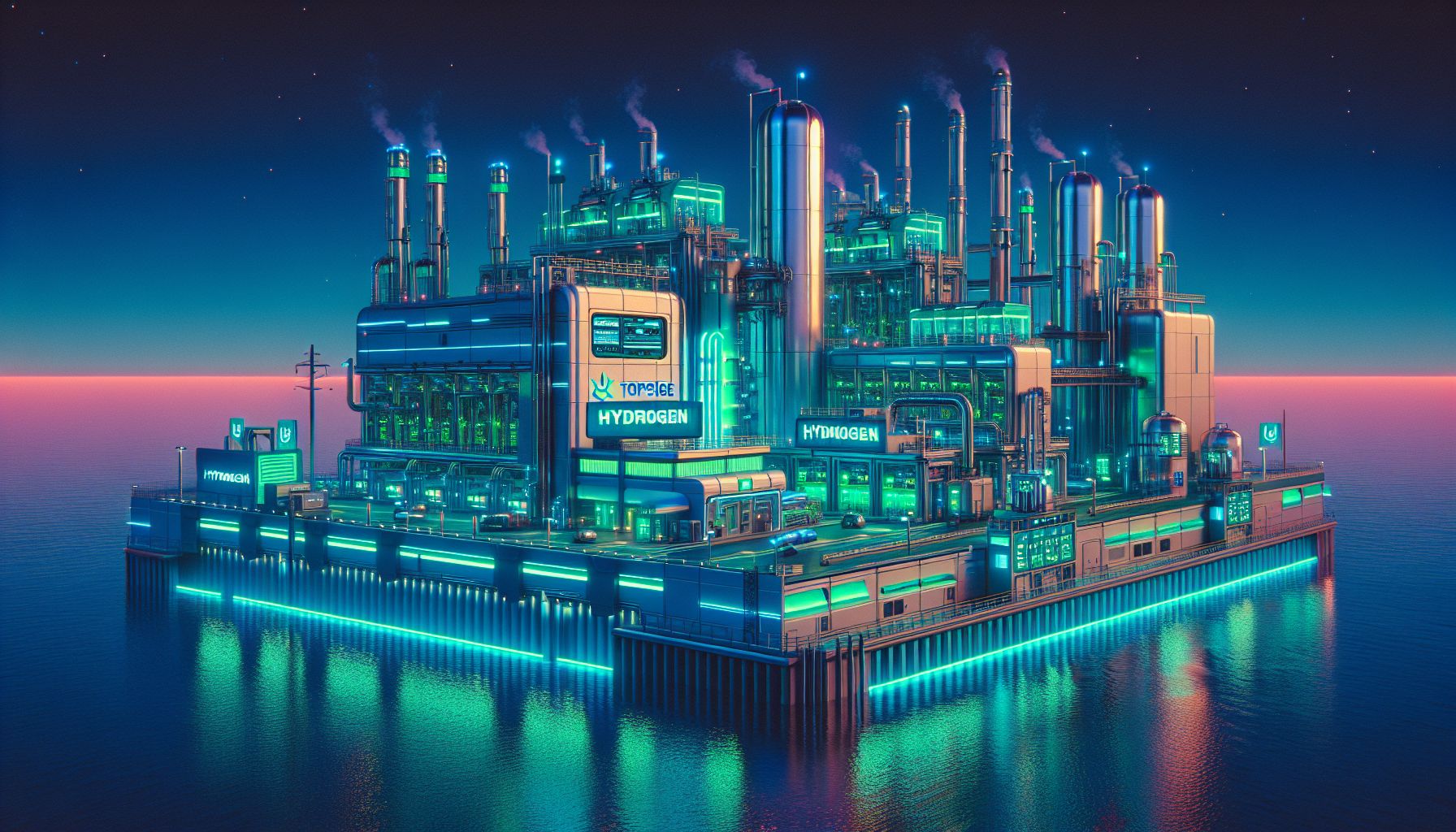

Topsoe's Virginia Hydrogen Factory Halt: Market Demand Stalls Progress

Virginia, Monday, 27 October 2025.

Topsoe paused its Virginia factory plans due to a steep drop in electrolyzer demand, highlighting challenges in green hydrogen’s U.S. future. The halt underscores a shift towards cheaper blue hydrogen solutions.

A Sudden Shift in Plans

Hey there! So, Topsoe’s decision to pause its Virginia factory plans due to a massive 94% drop in green hydrogen investments last year isn’t just a small hiccup—it’s a significant pivot for the company and the industry [1]. The factory, which was supposed to be a $400 million cornerstone in Richmond, faced the chopping block after the 45V clean hydrogen production tax credit expired, leaving the green hydrogen market in a bit of a lurch [2].

Market Dynamics and Blue Hydrogen

The U.S. market’s shift towards cheaper blue hydrogen, produced using natural gas with carbon capture, is shaking things up [1]. This change is largely due to the loss of tax credits for green hydrogen, making blue hydrogen more attractive economically. It’s like choosing between a pricey organic apple and a regular one—sometimes the wallet wins [2].

Not Just Topsoe, But a Broader Trend

Interestingly, it’s not just Topsoe feeling the heat. Earlier this year, Nel Hydrogen, a Norwegian company, also pulled back on its electrolyzer plans in Michigan, citing similar market challenges [1]. It’s a clear message that the current U.S. demand for green hydrogen and electrolyzers isn’t as robust as hoped [3].

Looking Ahead: Europe as a New Frontier

But don’t fret! Topsoe is shifting its focus to Europe, where it’s about to launch a 500 MW factory in Denmark on 30 October 2025. This move underscores the company’s strategy to tap into markets with stronger policy support for green hydrogen [3]. It’s like finding a new playground where the swings are always free [2].

What’s Next for the Hydrogen Sector?

The future of green hydrogen in the U.S. hinges on policy and investment. Gabe Martinez from Topsoe mentioned that unlocking demand will need strong policy support and infrastructure investment. It sounds like the industry is waiting for another shot of adrenaline to really get moving [1]. Fingers crossed for some good news on that front soon [3].